Imagine walking into a bustling mall in India, surrounded by vibrant stores showcasing everything from sleek sneakers to classic loafers. The Indian footwear market is booming, valued at $26 billion in 2024 and projected to soar to $90 billion by 2030. With rising incomes, urbanization, and a fashion-conscious youth driving demand, it’s no surprise that investors are eyeing footwear stocks as a hot opportunity. Three companies stand out in this dynamic sector: Bata India, Relaxo Footwears, and Campus Activewear. Each has carved a unique niche, but which one offers the best investment potential? Let’s dive into a comprehensive comparison to find out, breaking down their financials, strategies, and market positioning in a way that’s clear for beginners and insightful for seasoned investors.

Company Overviews: Who Are They?

Bata India: The Trusted Legacy Brand

Picture a brand that’s been a household name for decades, synonymous with quality and reliability. That’s Bata India. Founded in 1931 as part of the global Bata Corporation, it’s one of India’s oldest and most recognized footwear brands. From humble beginnings, Bata has grown into a giant with over 1,577 stores across the country as of 2024, blending company-owned outlets, franchises, and a growing online presence. Bse

Bata’s product portfolio is vast, catering to everyone from office-goers in polished formal shoes to kids in playful sneakers. Brands like Hush Puppies, Weinbrenner, and Bata Comfit appeal to a broad audience, with a focus on formal and semi-formal wear. Its strength lies in its massive distribution network, reaching metros, Tier-II cities, and even smaller towns. Bata’s supply chain is a well-oiled machine, ensuring products are available nationwide. Bata

Key Strengths: Unmatched brand legacy, extensive retail network, and a diversified product range.

Challenges: Keeping up with fast-changing fashion trends and competing with trendy, youth-focused brands like Campus.

Relaxo Footwears: The King of Affordable Comfort

Now, think of footwear that’s everywhere—on the streets, in small towns, and in millions of homes. Relaxo Footwears, established in 1976, is India’s largest footwear manufacturer by volume, known for affordable, comfy products. Its brands like Sparx, Flite, and Bahamas dominate the mass market, offering slippers, sandals, and casual shoes that don’t break the bank.

Relaxo’s business model is all about cost leadership. With state-of-the-art manufacturing facilities, it keeps production costs low, passing savings to consumers. Its distribution network is a powerhouse, penetrating deep into Tier-II and Tier-III cities through retailers and distributors, complemented by a growing e-commerce presence. Relaxo’s scale is impressive, and its focus on affordability keeps it a favorite among budget-conscious consumers.

Key Strengths: Dominance in the value segment, cost-efficient operations, and widespread reach.

Challenges: Vulnerability to raw material price hikes and competition from unorganized players.

Campus Activewear: The Youthful Trailblazer

If Bata is the seasoned veteran and Relaxo the mass-market champion, Campus Activewear is the young, energetic disruptor. Launched in 2008, Campus has quickly become a leader in India’s sports and athleisure footwear market, capturing a 17% market share in this segment. Its focus? Trendy, performance-oriented shoes that resonate with millennials and Gen Z.

Campus offers over 2,400 styles, from running shoes to casual sneakers, blending style and technology. Its marketing is spot-on, leveraging social media and influencer collaborations to connect with young consumers. With a growing network of exclusive brand outlets (EBOs) and e-commerce platforms, Campus is riding the athleisure wave, appealing to the fitness-conscious youth.

Key Strengths: Strong appeal to youth, innovative designs, and high growth potential.

Challenges: Fierce competition from global giants like Nike and Adidas, plus maintaining consistent growth.

Financial Performance Analysis: The Numbers Game

Let’s get to the heart of the matter—financials. Numbers tell a story, and understanding them is key to making informed investment decisions. Using the latest data you’ve provided, we’ll compare Bata, Relaxo, and Campus across key metrics. I’ll break down each metric in simple terms for beginners while offering deeper insights for seasoned investors. The data reflects the most recent figures, giving us a clear picture of their performance. Screener.in

Current Market Price (CMP) and Price-to-Earnings (P/E) Ratio

The Current Market Price (CMP) shows what the stock is trading at, while the P/E ratio tells us how much investors are willing to pay for each rupee of earnings—a higher P/E often means the market expects strong future growth.

- Bata India: CMP is ₹1,195.80, with a P/E of 43.21. This suggests the market values Bata’s earnings at a premium, reflecting confidence in its stability, but it’s not as high as peers, indicating a more balanced growth outlook.Sources

- Relaxo Footwears: CMP is ₹401.85, with a P/E of 58.73. A higher P/E shows the market is optimistic about Relaxo’s future, likely due to its improving profitability and mass-market dominance. Sources

- Campus Activewear: CMP is ₹240.43, with a P/E of 61.76. The highest P/E in the group reflects strong growth expectations, driven by its position in the booming athleisure segment. Sources

Insight: Campus’s high P/E signals that investors are betting on its growth, but it also means higher risk if expectations aren’t met. Bata’s lower P/E suggests a safer, value-oriented stock, while Relaxo sits in the middle, balancing growth and stability.

Market Capitalization and Promoter Holding

Market Cap shows the total value of a company’s shares, giving a sense of its size. Promoter Holding indicates how much of the company is owned by its founders or insiders—higher promoter holding often signals confidence in the business.

- Bata India: Market Cap is ₹15,369.32 crore, with promoters holding 50.16%. A solid market cap and balanced promoter holding show stability and trust.

- Relaxo Footwears: Market Cap is ₹10,003.60 crore, with promoters holding 71.27%. A smaller market cap reflects its focus on the mass market, but the high promoter holding is a strong vote of confidence.

- Campus Activewear: Market Cap is ₹7,342.69 crore, with promoters holding 72.14%. The smallest market cap aligns with its younger age, but high promoter holding signals belief in its growth story. Source BSE

Insight: Bata’s larger market cap makes it a heavyweight, appealing to investors seeking stability. Relaxo and Campus, with smaller market caps and high promoter stakes, are more growth-oriented but riskier.

Revenue Growth (Sales Var 5Yrs %)

Revenue growth over five years (Sales Var 5Yrs %) shows how fast a company’s top line is expanding, a key indicator of business health.

- Bata India: Sales growth over five years is 3.48%. This modest growth reflects Bata’s mature market position—its focus on formal and semi-formal footwear faces slower demand compared to casual trends. Screener.in

- Relaxo Footwears: Sales growth is 2.96%. Slightly lower than Bata, Relaxo’s growth is steady but constrained by its low-price, high-volume model, which limits revenue upside. Business-standard

- Campus Activewear: Sales growth is a standout at 25.57%. This explosive growth highlights the athleisure boom and Campus’s success in capturing youth demand.

Insight: Campus is the clear winner in revenue growth, reflecting its niche in a high-demand segment. Bata and Relaxo, while stable, are growing more slowly as they cater to more saturated markets.

Profitability (Profit Var 5Yrs %)

Profit growth over five years (Profit Var 5Yrs %) shows how well a company is increasing its bottom line.

- Bata India: Profit declined by 2.37% over five years. This dip likely stems from rising costs and softer demand in its core segments, a challenge for a legacy brand adapting to new trends.

- Relaxo Footwears: Profit dropped by 5.52%, a steeper decline. This could be due to raw material price volatility, a key challenge for Relaxo given its focus on affordability.

- Campus Activewear: Profit grew by 17.44%, a strong performance. This aligns with its revenue growth, showing Campus is successfully converting sales into profits despite higher costs in the growth phase.

Insight: Campus’s profit growth is impressive, making it a darling for growth investors. Bata and Relaxo’s profit declines raise concerns, but their established operations provide a buffer.

Return on Equity (ROE)

ROE measures how well a company uses shareholders’ money to generate profits—a higher ROE indicates better efficiency.

- Bata India: ROE is 19.76%. A strong ROE shows Bata is efficiently using equity to generate returns, a plus for value investors.

- Relaxo Footwears: ROE is 8.31%. A lower ROE reflects Relaxo’s high-volume, low-margin model, which prioritizes scale over profitability.

- Campus Activewear: ROE is 14.88%. A solid ROE for a growth company, balancing reinvestment with returns to shareholders.

Insight: Bata leads in ROE, showcasing its capital efficiency. Campus’s ROE is respectable for a growth stock, while Relaxo’s lower ROE aligns with its mass-market focus.

Debt-to-Equity Ratio

A low Debt-to-Equity ratio indicates financial stability, showing how much debt a company uses compared to its equity.

- Bata India: Debt-to-Equity is 0.98. While not debt-free, this is manageable, reflecting Bata’s cautious approach to financing.

- Relaxo Footwears: Debt-to-Equity is just 0.10, nearly debt-free. This low leverage makes Relaxo resilient to economic downturns.

- Campus Activewear: Debt-to-Equity is 0.32, higher than Relaxo but still moderate. This debt supports Campus’s expansion but adds slight risk.

Insight: Relaxo’s near debt-free status is a major strength, especially in volatile markets. Bata’s higher ratio is still safe, while Campus’s debt reflects its growth ambitions.

Earnings Per Share (EPS) 12M

EPS over the trailing 12 months shows per-share profitability, a key metric for investors.

- Bata India: EPS is ₹27.11. A solid EPS reflects Bata’s steady profitability, despite recent challenges.

- Relaxo Footwears: EPS is ₹6.84. Lower EPS aligns with its low-margin model, but recent improvements are encouraging.

- Campus Activewear: EPS is ₹3.89. A lower EPS is typical for a growth company reinvesting profits, but it’s still positive.

Insight: Bata’s higher EPS makes it attractive for income-focused investors. Relaxo and Campus’s lower EPS reflect their focus on growth over immediate profits.

Valuation Ratios: CMP/Sales and CMP/BV

CMP/Sales (Price-to-Sales) and CMP/BV (Price-to-Book Value) give further insight into how the market values these companies relative to their revenue and assets.

- CMP/Sales:

- Bata India: 4.39

- Relaxo Footwears: 3.59

- Campus Activewear: 3.89

- CMP/BV:

- Bata India: 10.46

- Relaxo Footwears: 12.13

- Campus Activewear: 10.60

Insight: Bata’s higher CMP/Sales suggests the market values its revenue at a premium, reflecting its brand strength. Relaxo’s higher CMP/BV indicates the market sees value in its assets, while Campus’s balanced ratios align with its growth narrative.

Additional Metrics: Debt-to-Receivables and Days Receivable

Debt-to-Receivables and Days Receivable show how efficiently a company manages its credit sales and collects payments.

- Debt-to-Receivables:

- Bata India: 8.41

- Relaxo Footwears: 40.83

- Campus Activewear: 4.73

- Days Receivable:

- Bata India: 4.67

- Relaxo Footwears: 1.25

- Campus Activewear: 29.80

Insight: Relaxo’s high Debt-to-Receivables but low Days Receivable suggests it extends credit but collects quickly, a strength in the mass market. Campus’s higher Days Receivable indicates slower collections, a potential risk as it scales. Bata’s balanced metrics show operational efficiency.

Growth Drivers and Future Outlook: How They’ll Grow

The Indian footwear market is on fire, driven by rising disposable incomes, urbanization, and a fitness craze among the youth. E-commerce is reshaping how consumers shop, with online sales surging. Government initiatives, like the Indian Footwear, Leather & Accessories Development Programme (IFLADP), are boosting production and exports. Let’s see how our companies plan to capitalize.

Bata India

Bata is doubling down on modernization, revamping stores to attract younger shoppers. It’s expanding into Tier-II and Tier-III cities, where demand for branded footwear is growing. The company is also embracing “sneakerization,” with casual and athletic shoes now making up 50–55% of sales, aiming for 60–65% in three years. Its e-commerce push and new product lines (like accessories) are key growth drivers. Despite profit challenges, its strong ROE and manageable debt position it well for steady growth.

Risks: Intense competition from global brands and economic slowdowns could dent demand.

Relaxo Footwears

Relaxo is sticking to its bread-and-butter: affordable footwear. It’s expanding its product range, adding more premium options under Sparx to capture higher margins. Plans include adding 50–60 new EBOs and boosting e-commerce through its “Brand as a Seller” model. Relaxo targets double-digit revenue growth with improving profitability, as seen in its recent profit recovery. Its near debt-free status adds resilience.

Risks: Raw material price volatility and competition from unorganized players could squeeze margins.

Campus Activewear

Campus is all about innovation and youth appeal. It’s launching new styles and integrating tech into its shoes, like cushioning for runners. Marketing campaigns with influencers and social media are keeping it trendy. Campus expects demand to rebound post-monsoon, with the festive season and BIS standards (limiting low-cost imports) boosting growth. Its explosive sales growth (25.57% over five years) and solid profit growth (17.44%) make it a growth star, though higher receivables need attention.

Risks: Global giants like Puma and Adidas pose stiff competition, and sustaining high growth is tough.

Comparative Analysis: Head-to-Head

Let’s put it all together in a snapshot:

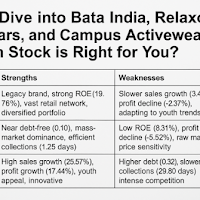

| Company | Strengths | Weaknesses |

|---|---|---|

| Bata India | Legacy brand, strong ROE (19.76%), vast retail network, diversified portfolio | Slower sales growth (3.48%), profit decline (-2.37%), adapting to youth trends |

| Relaxo Footwears | Near debt-free (0.10), mass-market dominance, efficient collections (1.25 days) | Low ROE (8.31%), profit decline (-5.52%), raw material price sensitivity |

| Campus Activewear | High sales growth (25.57%), profit growth (17.44%), youth appeal, innovative | Higher debt (0.32), slower collections (29.80 days), intense competition |

Investment Considerations:

- Bata India: Ideal for value investors seeking stability. Its high ROE, solid EPS (₹27.11), and moderate P/E (43.21) make it a safer bet during market downturns.

- Relaxo Footwears: Suits balanced investors who want steady growth with low risk. Its near debt-free status and high promoter holding (71.27%) are reassuring, though low ROE needs monitoring.

- Campus Activewear: Best for growth investors willing to take risks for high returns. Its high P/E (61.76) and strong growth metrics make it exciting, but higher debt and receivables add risk.

Key Differentiators:

- Bata’s brand equity, ROE, and reach make it a steady performer.

- Relaxo’s low debt and mass-market focus ensure resilience.

- Campus’s growth metrics and youth-centric approach position it for explosive potential in a booming segment.

Conclusion: Finding Your Fit

Choosing between Bata India, Relaxo Footwears, and Campus Activewear is like picking the perfect pair of shoes—it depends on your style and goals. Bata offers reliability, like a classic pair of loafers, with strong fundamentals for cautious investors. Relaxo is the comfy sandal, delivering steady value with low risk for balanced investors. Campus is the flashy sneaker, exciting but riskier, ideal for growth-chasers betting on the athleisure trend.

The Indian footwear market is brimming with potential, but each company faces unique challenges. Bata must boost growth, Relaxo needs to manage costs, and Campus has to fend off global giants while improving collections. Before investing, dig deeper into their quarterly results, track market trends, and assess your risk tolerance. The stock market isn’t a sprint—it’s a marathon. Do your homework, and you’ll find the stock that fits you best.